In the dynamic world of e-commerce, seamless transactions are paramount to driving sales and customer satisfaction. A robust and reliable payment gateway is the backbone of any successful online store, facilitating secure and convenient transactions for your customers. Choosing the right payment gateway can be a daunting task, with numerous options available, each with its unique features and benefits. This comprehensive guide will equip you with the knowledge and insights needed to navigate the complex landscape of payment gateways and select the ideal solution for your e-commerce business.

From understanding the fundamentals of payment gateway integration to exploring the key factors to consider, this article will provide a step-by-step approach to making an informed decision. We’ll delve into the various payment gateway types, popular providers, and essential functionalities to ensure your online store processes payments efficiently and securely. By the end of this guide, you’ll be empowered to choose the best payment gateway for your e-commerce business, enabling you to unlock seamless transactions and propel your online success.

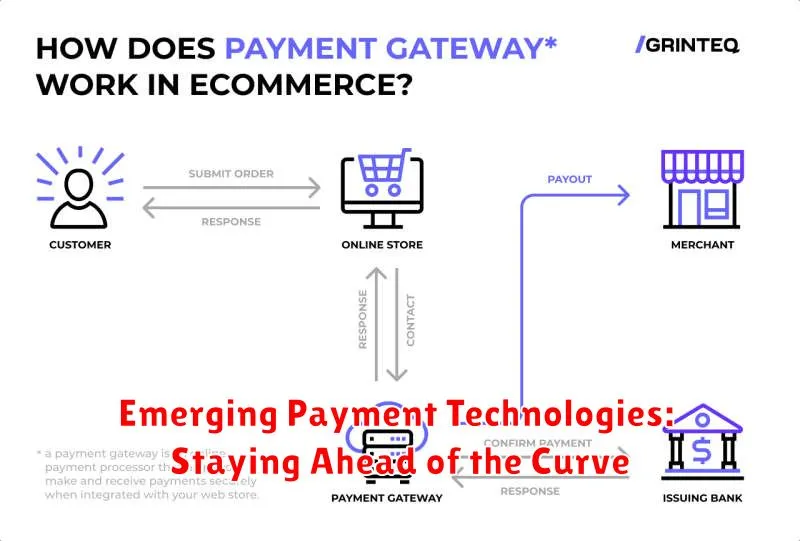

What is a Payment Gateway and Why is it Crucial for Ecommerce?

Imagine setting up a beautifully designed online store, showcasing your products, and attracting customers. But, what happens when it’s time to actually purchase? This is where a payment gateway steps in, acting as the bridge between your customers and your bank, enabling secure and seamless online transactions.

Think of it as the digital cashier of your ecommerce business. It’s the secure platform that processes online payments from your customers, verifies their details, and transmits the transaction data to your bank for approval. Without a payment gateway, you wouldn’t be able to accept credit card payments, debit card payments, or other digital payment methods – essentially crippling your online business.

The crucial role of a payment gateway in ecommerce cannot be overstated. It ensures:

- Secure and reliable transactions: Payment gateways utilize encryption and advanced security protocols to safeguard sensitive customer data, protecting both you and your customers from fraud.

- Multiple payment options: Customers prefer flexibility, and a payment gateway allows you to offer a variety of payment methods, such as credit cards, debit cards, digital wallets, and bank transfers, catering to diverse preferences.

- Simplified checkout process: A user-friendly payment gateway streamlines the checkout experience, making it easy and convenient for customers to complete their purchases. This, in turn, reduces shopping cart abandonment rates.

- Real-time transaction status updates: Payment gateways provide instant confirmation of successful payments, allowing you to process orders promptly and keep customers informed.

In essence, a reliable payment gateway is the backbone of any successful ecommerce business. It enables smooth and secure transactions, fostering trust and customer satisfaction, ultimately contributing to your online store’s growth.

Types of Payment Gateways: Exploring Your Options

Navigating the world of payment gateways can feel overwhelming, especially when you’re just starting out. But understanding the different types can empower you to choose the best fit for your ecommerce business. Here’s a breakdown of the most common options:

1. Traditional Payment Gateways

Think of these as the industry veterans. They process credit card transactions directly through major card networks like Visa, Mastercard, and American Express. Examples include Stripe, PayPal, and Authorize.net. Traditional gateways are generally secure and reliable, making them a solid choice for businesses of all sizes.

2. Mobile Payment Gateways

The rise of mobile commerce has led to the emergence of mobile-specific payment gateways. These platforms cater to the growing trend of consumers using their smartphones to make purchases. Apple Pay, Google Pay, and Samsung Pay are prominent examples, offering a streamlined and secure checkout experience.

3. Alternative Payment Gateways

These are the disruptors, offering unique payment methods beyond traditional credit cards. They cater to specific niches and preferences. Some popular examples include: * eWallets: These digital wallets like PayPal, Venmo, and Skrill enable fast and easy transactions. * Buy Now, Pay Later (BNPL): Platforms like Klarna, Afterpay, and Affirm offer installment plans, increasing accessibility and affordability. * Cryptocurrency Gateways: These facilitate transactions using cryptocurrencies like Bitcoin and Ethereum, appealing to a tech-savvy audience.

4. Merchant Account Gateways

If you process a high volume of transactions, a merchant account gateway might be the right choice. It allows you to accept payments directly from your bank, providing greater control over your finances and often lower transaction fees. However, setting up a merchant account can be more complex and require a larger initial investment.

Factors to Consider When Choosing a Payment Gateway

Choosing the right payment gateway is crucial for any ecommerce business. It’s the backbone of your online checkout process, directly impacting customer experience and your ability to process payments securely and efficiently. With numerous payment gateways available, selecting the ideal one for your specific needs can feel overwhelming. To help you navigate this decision, here are key factors to consider:

Supported Payment Methods: This is the most fundamental aspect. Consider which payment methods are most popular in your target market. Do you need to support credit cards, debit cards, digital wallets like PayPal, Apple Pay, or Google Pay, or even alternative payment methods like cryptocurrency? Ensure the gateway supports the options you require.

Fees and Pricing: Payment gateways charge fees for processing transactions. These fees can vary based on factors like transaction volume, payment method, and location. Compare pricing models, including transaction fees, monthly fees, and setup fees. Look for transparent pricing structures and potential discounts for high-volume businesses.

Security and Compliance: Security is paramount for any online transaction. Ensure the gateway you choose meets industry standards like PCI DSS compliance and offers features such as encryption and fraud prevention. A secure gateway builds trust with customers and protects your business from security breaches.

Integration and Compatibility: The gateway should integrate seamlessly with your ecommerce platform. Consider factors like ease of setup, available API documentation, and support for various shopping carts and platforms. Compatibility with your existing systems will simplify the integration process and minimize potential issues.

Customer Support: A reliable customer support system is crucial for addressing issues that may arise during the integration or payment process. Look for payment gateways that offer prompt and responsive support through various channels like phone, email, or live chat.

Scalability: As your business grows, your payment gateway should be able to handle increased transaction volumes without experiencing performance issues. Consider the gateway’s capacity and infrastructure to ensure it can scale with your future growth.

Reporting and Analytics: Choose a gateway that provides detailed reporting and analytics on transaction data. This will help you understand customer behavior, identify trends, and optimize your sales processes. Look for features like real-time transaction monitoring, detailed reports, and customizable dashboards.

International Payments: If you plan to expand your business internationally, ensure the gateway supports international transactions and various currencies. Consider features like multi-currency support, global payment processing, and currency exchange rates.

By carefully considering these factors, you can choose a payment gateway that aligns with your business needs, ensures secure and seamless transactions, and supports your long-term growth. Investing in the right payment gateway is an investment in your ecommerce success.

Security and Fraud Prevention: Protecting Your Business and Customers

In the realm of e-commerce, security and fraud prevention are paramount. Choosing the right payment gateway is crucial to safeguarding both your business and your customers. A robust payment gateway should offer a multi-layered approach to security, encompassing:

Data Encryption: All sensitive data, including credit card information, should be encrypted using industry-standard protocols like SSL/TLS, ensuring that data is transmitted securely between your website and the payment processor.

Tokenization: Instead of storing sensitive data directly, payment gateways utilize tokenization. This replaces actual card details with unique tokens, making it difficult for unauthorized parties to access sensitive information.

Fraud Detection: Advanced fraud detection systems are essential. Payment gateways should employ machine learning algorithms and real-time monitoring to analyze transactions for suspicious patterns, reducing the risk of fraudulent activities.

PCI DSS Compliance: Ensuring your payment gateway and processes adhere to the Payment Card Industry Data Security Standard (PCI DSS) is crucial. This compliance demonstrates a commitment to data security and helps build trust with customers.

Two-Factor Authentication (2FA): Implementing 2FA adds an extra layer of security, requiring users to provide two distinct forms of authentication before accessing their accounts or completing transactions. This further mitigates the risk of unauthorized access.

By prioritizing these security features, you can create a secure and trustworthy environment for your customers, fostering confidence in your e-commerce business. A secure payment gateway is an essential investment for long-term success and customer satisfaction.

Transaction Fees and Pricing Structures: Understanding the Costs

When selecting a payment gateway for your e-commerce business, understanding the associated transaction fees and pricing structures is crucial. These costs can significantly impact your profitability, so it’s essential to carefully evaluate each option.

Transaction Fees are a common expense charged by payment gateways for processing each transaction. They are typically expressed as a percentage of the transaction amount plus a fixed fee per transaction. For example, a gateway might charge a 2.9% fee plus $0.30 per transaction. These fees can vary based on factors such as the payment method used (e.g., credit card, debit card, PayPal), transaction volume, and the specific payment gateway provider.

In addition to transaction fees, payment gateways may also have other pricing structures, such as:

- Monthly Fees: Some gateways charge a recurring monthly fee for access to their services.

- Setup Fees: An initial fee might be charged for setting up an account with the gateway.

- Chargeback Fees: When a customer disputes a charge, the gateway might levy a chargeback fee.

- International Transaction Fees: Processing transactions in foreign currencies can come with additional fees.

- Recurring Billing Fees: If you offer subscription services, you may be charged additional fees for recurring payments.

It’s important to carefully review each payment gateway’s pricing structure and understand all the associated costs before making a decision. Factors to consider when evaluating pricing include:

- Transaction Volume: High-volume merchants might benefit from payment gateways that offer lower per-transaction fees.

- Average Transaction Value: If your transactions are typically small, a gateway with a higher percentage fee might be more expensive than one with a lower percentage fee but higher fixed fees.

- Payment Methods Accepted: Consider the specific payment methods your target audience uses, as some gateways may have different pricing for different payment types.

- Other Features: Some gateways offer additional features such as fraud protection, customer support, and reporting that may come with additional costs.

By carefully comparing the transaction fees and pricing structures of different payment gateways, you can select the most cost-effective solution for your e-commerce business.

Supported Payment Methods: Catering to a Global Audience

When you’re expanding your ecommerce business to reach a global audience, one of the most crucial factors for success is offering a diverse range of payment options. Customers from different regions have varying preferences and familiar payment methods, and failing to cater to these preferences can significantly impact your conversion rates and customer satisfaction.

Here are some key considerations when choosing supported payment methods for a global audience:

Popular Local Payment Methods

Researching the most popular payment methods in your target markets is essential. In certain regions, local payment gateways and methods like Alipay and WeChat Pay in China, Klarna in Europe, and boleto bancario in Brazil, are widely preferred and often outpace the popularity of traditional credit cards. Offering these familiar options can greatly improve conversion rates and customer trust.

Global Reach and Acceptance

While catering to local preferences is vital, it’s also important to ensure your payment gateway supports widely accepted global payment methods like Visa, Mastercard, American Express, Discover, and PayPal. These options provide a reliable and secure fallback for customers who might not be comfortable with local methods.

Currency Support

Offering multiple currency options can significantly enhance the user experience. Customers appreciate the convenience of making purchases in their local currency, eliminating the need for currency conversions and potential price fluctuations. A payment gateway that supports a wide range of currencies helps create a seamless and hassle-free checkout experience.

Security and Compliance

Security is paramount for any online transaction. When choosing payment methods, ensure your payment gateway complies with international security standards like PCI DSS and offers robust fraud prevention measures. This builds trust with customers and protects your business from financial losses.

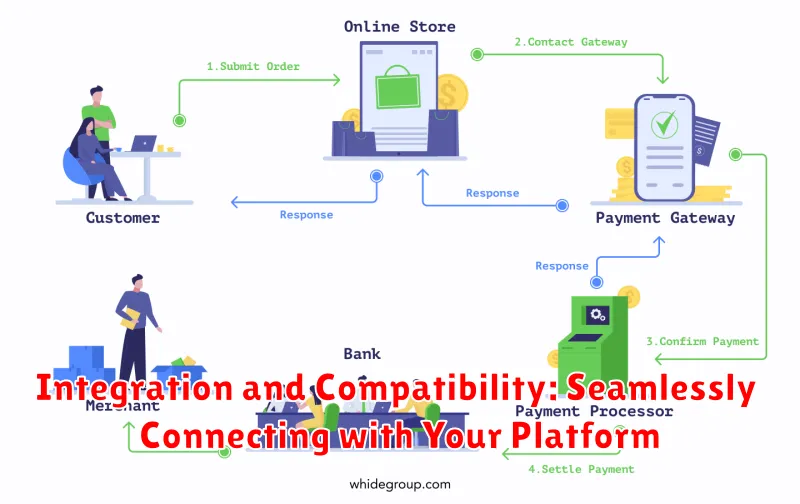

Integration and Compatibility: Seamlessly Connecting with Your Platform

A smooth checkout experience is crucial for converting customers and boosting sales. This is where the integration and compatibility of your chosen payment gateway become paramount. Your payment gateway should seamlessly integrate with your existing ecommerce platform, whether it’s Shopify, WooCommerce, Magento, or another platform.

Seamless integration ensures a streamlined checkout process for your customers, minimizing friction and potential abandonment. Look for gateways that offer pre-built integrations or APIs for your platform.

Compatibility refers to the gateway’s ability to work smoothly with your website’s design, security measures, and other features. You need a payment gateway that can securely handle sensitive customer data and comply with relevant industry standards.

Consider these factors when assessing integration and compatibility:

- Ease of Installation: Can you set up the gateway without needing extensive technical expertise?

- API Documentation: Is the API well-documented and easy to understand for developers?

- Customer Support: Does the provider offer reliable support if you encounter integration issues?

- Security: Does the gateway meet the security standards of your industry and your platform?

By carefully evaluating integration and compatibility, you can choose a payment gateway that seamlessly connects with your platform, ensuring a smooth and secure checkout process for your customers.

Customer Support and Dispute Resolution: Essential for Smooth Operations

Beyond just processing payments, a reliable payment gateway should provide robust customer support and dispute resolution processes. These elements are crucial for ensuring a smooth and positive customer experience, especially when issues arise. Consider the following factors:

Availability and Responsiveness: A responsive customer support team is essential for resolving issues promptly and efficiently. Look for payment gateways that offer multiple communication channels, such as email, phone, and live chat, with 24/7 or near-24/7 availability.

Dispute Resolution Processes: Disputes can occur, and a payment gateway should have clear and transparent processes for handling them. Look for features like chargeback protection, fraud prevention tools, and detailed transaction records that can help resolve disputes quickly and fairly.

Customer-Friendly Interface: A user-friendly interface for managing disputes and contacting customer support is essential. The process should be simple and intuitive, allowing merchants to easily track disputes and communicate with customers.

Proactive Measures: Prevention is better than cure. Choose a payment gateway that proactively monitors transactions for suspicious activity and utilizes fraud detection tools to minimize disputes. They should also provide clear guidelines for merchants to prevent fraudulent transactions.

Investing in a payment gateway with exceptional customer support and dispute resolution capabilities can significantly enhance your business operations and customer satisfaction. It allows you to handle issues efficiently and maintain a positive brand image, ultimately leading to greater customer loyalty and trust.

User Experience: Making Payments Easy and Convenient for Customers

In the competitive world of e-commerce, a smooth and effortless checkout experience is crucial for driving conversions and fostering customer loyalty. A seamless payment gateway is the backbone of this experience, ensuring that customers can complete their transactions quickly, securely, and without friction.

A well-designed payment gateway offers multiple advantages for both you and your customers:

- User-friendly interface: A clear and intuitive interface allows customers to navigate the checkout process with ease, minimizing confusion and frustration.

- Multiple payment options: Offering a variety of payment methods, such as credit cards, debit cards, digital wallets, and even installment plans, provides customers with greater flexibility and convenience.

- Security and trust: A reputable payment gateway utilizes robust security measures to protect sensitive customer information, instilling confidence and encouraging repeat purchases.

- Mobile optimization: With the rise of mobile commerce, ensuring your payment gateway is fully optimized for mobile devices is essential for capturing a larger audience.

- Fast and reliable processing: Quick processing times and minimal delays minimize the risk of cart abandonment, ensuring a seamless experience for your customers.

Ultimately, a payment gateway that prioritizes user experience translates into higher conversion rates, reduced cart abandonment, and increased customer satisfaction. By investing in a gateway that meets these criteria, you’re taking a significant step toward creating a truly exceptional online shopping experience for your customers.

Mobile Optimization: Ensuring Smooth Mobile Transactions

In today’s mobile-first world, it’s crucial to ensure your ecommerce platform offers a seamless experience for mobile users. This includes optimizing your checkout process for smooth transactions. Mobile users often face challenges like slow loading times, clunky forms, and difficult navigation, leading to cart abandonment. To avoid this, consider the following tips for mobile optimization:

Responsive Design: Ensure your website adapts flawlessly to different screen sizes. A responsive design automatically adjusts layout and content for optimal viewing on mobile devices, improving user experience and reducing frustration.

Simplified Forms: Minimize the number of form fields required for checkout. Mobile users are often on the go and prefer a quick and effortless experience. Limit fields to essential information, such as name, email, and payment details.

One-Click Checkout: Offer a streamlined checkout process with options like saved payment information and address. These features expedite transactions and reduce the chances of customers abandoning their carts.

Clear Call-to-Actions (CTAs): Use prominent and easy-to-understand CTAs that encourage mobile users to complete their purchases. Keep buttons large and easily tappable for a seamless user experience.

Mobile-Friendly Payment Gateways: Select a payment gateway that prioritizes mobile optimization. Look for features like support for mobile wallets, QR code scanning, and secure payment processing.

By optimizing your mobile checkout process, you can significantly improve customer satisfaction and boost conversion rates. A smooth and efficient mobile experience leads to a more positive perception of your brand and encourages repeat business.

Recurring Billing and Subscription Management

For businesses with recurring revenue models, choosing a payment gateway with robust recurring billing and subscription management features is crucial. These features streamline your operations, automate payments, and enhance customer satisfaction. Look for gateways that offer:

- Flexible billing cycles: Allow you to set up subscriptions with various billing frequencies (daily, weekly, monthly, annually, etc.).

- Automated payment processing: Ensures timely and reliable payment collection, eliminating manual intervention and reducing late payments.

- Customer self-service portal: Empower customers to manage their subscriptions, update payment information, and cancel subscriptions easily.

- Detailed reporting and analytics: Provide insights into subscription performance, churn rates, and customer behavior, helping you optimize your business strategy.

- Trial periods and discounts: Facilitate attractive subscription offers to attract new customers and increase conversion rates.

- Proration and refunds: Handle subscription adjustments and refunds efficiently, ensuring transparency and customer satisfaction.

A gateway with strong recurring billing and subscription management capabilities will simplify your payment processes, enhance customer experience, and ultimately boost your revenue.

Emerging Payment Technologies: Staying Ahead of the Curve

The world of online payments is constantly evolving, with new technologies and trends emerging all the time. To stay competitive in the ever-growing e-commerce landscape, it is crucial for businesses to adopt and embrace these emerging payment technologies. These innovations are not just about convenience, but they also offer enhanced security, faster processing speeds, and a more user-friendly experience for customers.

One of the most notable trends is the rise of mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay. These platforms allow users to make payments quickly and securely using their smartphones, eliminating the need for physical cards.

Another significant development is the growing popularity of Buy Now, Pay Later (BNPL) services. This offers consumers the ability to pay for their purchases in installments, making it easier to manage large expenses and spreading the cost over time. Services like Klarna, Afterpay, and Affirm are becoming increasingly popular, particularly among younger generations.

The integration of biometric authentication is revolutionizing online payments. Using fingerprint scanning, facial recognition, and voice recognition, customers can authenticate transactions in a more secure and convenient way.

Additionally, the emergence of cryptocurrencies is opening new doors for online payments. While still in its early stages, the use of cryptocurrencies like Bitcoin and Ethereum for online transactions is gaining traction, offering a decentralized and transparent alternative to traditional payment methods.

Adopting these emerging payment technologies allows e-commerce businesses to remain ahead of the curve, providing customers with a seamless and secure payment experience. By staying informed and adaptable, you can ensure that your business is equipped to handle the evolving landscape of online payments.

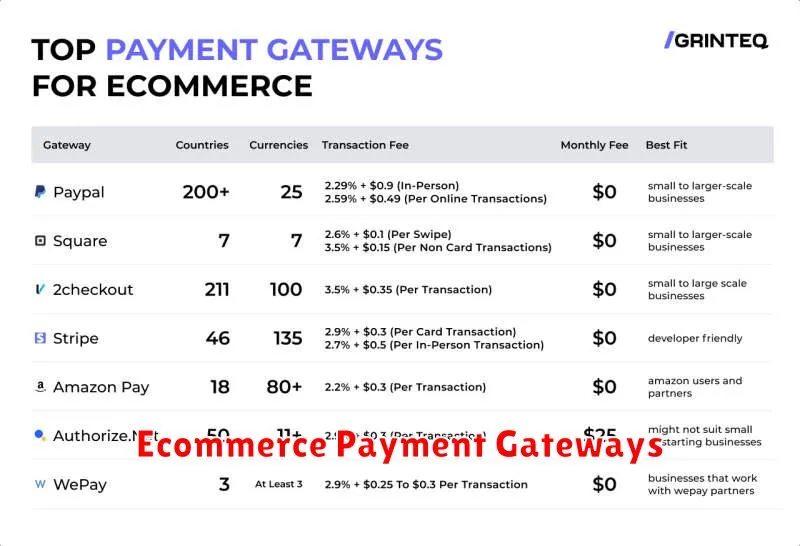

Top Payment Gateway Providers: A Comparative Analysis

Choosing the right payment gateway is crucial for any ecommerce business. It enables secure online transactions, ensuring customer trust and smooth checkout processes. With numerous options available, it’s essential to conduct a thorough analysis to select the best fit for your specific needs.

Here’s a comparative analysis of some top payment gateway providers, highlighting their key features, strengths, and considerations:

Stripe

Strengths:

- User-friendly interface and comprehensive documentation.

- Supports various payment methods, including credit cards, debit cards, and digital wallets.

- Offers robust fraud prevention tools.

- Excellent customer support.

Considerations:

- Higher transaction fees compared to some competitors.

- Limited support for recurring billing.

PayPal

Strengths:

- Widely recognized and trusted brand with a large user base.

- Seamless integration with various platforms.

- Offers buyer protection and seller dispute resolution.

Considerations:

- Higher transaction fees for certain transactions.

- Limited customization options for checkout pages.

Square

Strengths:

- Ideal for small businesses and mobile commerce.

- Offers POS systems and mobile payment processing.

- Transparent pricing and no monthly fees.

Considerations:

- Limited international payment support.

- May not be suitable for high-volume transactions.

Authorize.Net

Strengths:

- Highly secure and reliable payment gateway.

- Extensive API integration options for advanced customization.

- Offers fraud prevention and chargeback protection.

Considerations:

- More complex setup than some other providers.

- May not be the most user-friendly for beginners.

These are just a few examples of the many payment gateway providers available. Consider factors such as transaction volume, target audience, and business needs to determine the best fit for your ecommerce store. Evaluating these factors will enable you to make an informed decision and unlock seamless transactions for your customers.

Tips for Optimizing Your Payment Gateway Setup

Once you’ve chosen the right payment gateway for your ecommerce business, the next step is to optimize its setup for a seamless checkout experience. Here are some key tips:

1. Configure your gateway settings carefully: Ensure that you’ve set up your gateway to accept the payment methods your target audience prefers. This includes major credit cards, debit cards, digital wallets, and any other payment options that are relevant to your niche. Also, configure your gateway to support your currency and geographic location, especially if you have international customers.

2. Implement robust fraud prevention measures: To minimize the risk of fraudulent transactions, enable your gateway’s fraud detection and prevention features. This might include address verification, CVV checks, and order monitoring systems. You can also set up specific fraud rules based on your business needs.

3. Customize your checkout page: Your checkout page should be simple, intuitive, and mobile-friendly. Use clear call-to-actions, display the total price prominently, and consider offering guest checkout for faster processing.

4. Integrate your payment gateway with your other tools: Ensure that your gateway is seamlessly integrated with your website, shopping cart, and other ecommerce platforms. This will help to streamline your checkout process and reduce errors.

5. Provide clear and concise customer support: Offer your customers clear and accessible support channels, such as email, phone, or live chat. Provide comprehensive information on your website about how to manage payments, troubleshoot issues, and access transaction histories.

By carefully optimizing your payment gateway setup, you can create a smooth and secure checkout experience for your customers. This, in turn, can lead to increased sales and customer satisfaction.