In today’s competitive e-commerce landscape, standing out from the crowd and enticing customers to choose your products is crucial. One powerful strategy to achieve this is offering financing options. By providing flexible payment plans, you can remove financial barriers for potential customers, enabling them to purchase items they may otherwise hesitate to buy. This ultimately leads to increased sales and customer satisfaction.

Offering financing options not only makes your products more accessible but also fosters trust and loyalty among your customers. When you empower them to manage their purchases responsibly, they are more likely to return for future transactions. This article will explore the benefits of offering financing options for your e-commerce business and provide insights on how to effectively implement this strategy for optimal results.

Understanding the Appeal of Financing Options for Online Shoppers

In today’s digital age, online shopping has become the preferred choice for many consumers. The convenience and accessibility of online platforms have revolutionized the way people make purchases. However, the decision to buy can be influenced by a range of factors, including the price of the product. Here, financing options play a crucial role in attracting and converting online shoppers.

For many consumers, the prospect of making a large purchase can be daunting. Financing options provide a solution by allowing customers to spread the cost over time, making the purchase more affordable. This is particularly appealing to those who may be on a tight budget or prefer to manage their finances in installments. For example, shoppers might opt for financing to purchase a high-end appliance, a designer piece of furniture, or even a big-ticket item like a laptop or smartphone.

Furthermore, financing options can help to build customer loyalty and drive repeat purchases. When customers feel empowered to make larger purchases, they are more likely to return for future needs. By offering financing, businesses can enhance customer satisfaction and create a positive shopping experience. This can lead to increased brand loyalty and ultimately, greater sales.

In conclusion, offering financing options is a powerful strategy for online businesses seeking to attract and retain customers. By providing flexibility and affordability, these options make it easier for consumers to purchase desired items, leading to increased sales and customer loyalty.

Increased Purchasing Power and Reduced Cart Abandonment

Offering financing options can significantly increase your customers’ purchasing power. This allows them to buy products that they might not otherwise be able to afford, leading to increased sales for your business.

When customers can spread the cost of their purchase over time, they’re more likely to complete their purchase rather than abandon their cart. This is because financing can ease the financial burden, making the purchase more appealing and accessible.

Attracting a Wider Customer Base and Boosting Brand Loyalty

Offering financing options can be a powerful strategy for attracting a wider customer base and boosting brand loyalty. By allowing customers to spread out the cost of their purchases, you can make your products more accessible to a wider audience. This can be especially beneficial if you sell high-ticket items, such as furniture, electronics, or jewelry.

When customers are able to finance their purchases, they are more likely to make larger purchases that they might not otherwise be able to afford. This can lead to increased sales and revenue for your business. In addition, offering financing can also help to build brand loyalty. Customers who are able to take advantage of financing options are more likely to feel valued and appreciated by your business. This can lead to repeat purchases and positive word-of-mouth referrals.

Several financing options are available for your ecommerce business. You can partner with a third-party financing provider, offer in-house financing, or even offer a layaway program. No matter what financing option you choose, make sure to clearly communicate the terms and conditions to your customers. This will help to build trust and transparency with your customers.

In conclusion, offering financing options can be a valuable tool for attracting a wider customer base, boosting brand loyalty, and increasing sales for your ecommerce business. By making your products more accessible and offering flexible payment options, you can create a more positive customer experience and build a strong foundation for future success.

Types of Ecommerce Financing Options to Consider

Offering financing options can be a powerful tool to boost sales and make your products more accessible to customers. But with so many different options available, it can be tough to know where to start. Here’s a breakdown of some of the most popular ecommerce financing options:

Buy Now, Pay Later (BNPL): BNPL is a popular choice for online shoppers, allowing them to spread the cost of a purchase over several installments. Popular BNPL providers include Affirm, Klarna, Afterpay, and PayPal’s Pay in 4. The convenience and flexibility offered by BNPL can attract new customers and encourage larger purchases.

Credit Cards: While traditional credit cards may seem old-fashioned, they are still a widely accepted form of payment. Offering financing options through credit cards can be a good way to increase average order value and attract customers who prefer the familiarity of credit cards.

Personal Loans: For larger purchases, customers may prefer to take out a personal loan. Some online lenders specialize in providing financing for ecommerce purchases. Offering this option can cater to customers seeking a longer-term financing solution for big-ticket items.

Leasing: Leasing can be an attractive option for businesses that need to acquire expensive equipment or machinery. This option allows businesses to spread out the cost of an asset over time while gaining access to the latest technology.

Financing Through Your Own Platform: Some companies offer their own financing programs directly through their website. This can provide more control over the financing process and potentially offer more favorable terms to customers.

When choosing financing options for your ecommerce business, it’s important to consider factors like your target audience, average order value, and the cost of offering financing. Researching different providers and comparing their fees and terms can help you find the best fit for your needs.

Buy Now, Pay Later (BNPL) Programs: A Popular Choice

Buy Now, Pay Later (BNPL) programs have exploded in popularity in recent years, offering consumers a convenient and flexible way to make purchases. These programs allow customers to pay for their purchases in installments over a period of time, typically interest-free, with no upfront cost. This has made them a highly attractive option for shoppers, particularly younger generations who are often wary of traditional credit cards.

For ecommerce businesses, offering BNPL programs can be a powerful strategy to boost sales and conversions. By removing financial barriers, BNPL makes it easier for customers to make larger purchases or buy items they may not have been able to afford otherwise. This can lead to increased average order values and a significant rise in overall sales.

Moreover, BNPL programs can help businesses attract new customers and improve customer loyalty. Customers who use BNPL are more likely to return for future purchases, as they have experienced the convenience and affordability of the payment option.

The popularity of BNPL is undeniable. As a growing number of consumers embrace this payment method, savvy ecommerce businesses are realizing the immense potential it holds for driving growth and success.

Installment Plans: Offering Flexibility and Predictability

In today’s competitive ecommerce landscape, offering flexible payment options is crucial to attracting and converting customers. Installment plans are a powerful tool for achieving this, allowing customers to spread the cost of their purchases over time and enjoy the benefits of their purchases sooner.

For customers, installment plans offer significant advantages. They provide flexibility by allowing them to budget for larger purchases without straining their finances. This is particularly beneficial for high-ticket items like furniture, electronics, or even home renovations. By breaking down the cost into smaller, manageable installments, customers can avoid overwhelming their budgets and make purchases that they might otherwise have delayed.

Installment plans also offer predictability. Customers know exactly how much they will be paying each month and when. This can significantly reduce financial stress and help them plan their finances more effectively. For businesses, installment plans can increase sales by tapping into a wider customer base who may be hesitant to make large, upfront purchases. It can also help to reduce shopping cart abandonment, as customers feel more comfortable committing to a purchase when they know they can afford it.

Offering installment plans can also contribute to customer loyalty. By providing a convenient and flexible payment option, businesses demonstrate a commitment to their customers’ needs and financial well-being. This can foster trust and encourage repeat business.

Store Credit Cards: Encouraging Repeat Purchases

Offering a store credit card can be a powerful tool for boosting repeat purchases and customer loyalty. By providing a convenient and often rewarding way to pay, you can incentivize customers to return to your store again and again.

Here’s how store credit cards encourage repeat purchases:

- Exclusive Discounts and Rewards: Store credit cards often come with exclusive discounts, promotions, and reward programs that are only available to cardholders. This creates a sense of exclusivity and incentivizes customers to keep using their card.

- Easier Budgeting: By consolidating purchases onto a single card, customers can manage their spending more effectively and avoid the hassle of multiple bills. This can make it easier for them to stick to their budgets and make repeat purchases.

- Convenient Payment Options: Store credit cards can simplify the checkout process and make it easier for customers to make large purchases. This convenience can lead to increased spending and a higher likelihood of repeat purchases.

- Building Brand Loyalty: By providing a personalized credit card experience, you can foster a stronger connection with your customers and build brand loyalty. This can lead to increased customer lifetime value and long-term revenue growth.

While offering a store credit card requires careful consideration, it can be a valuable tool for increasing customer retention and driving revenue. By providing a convenient and rewarding payment option, you can encourage customers to return for more purchases and build lasting relationships with your brand.

Choosing the Right Financing Partner for Your Business

Offering financing options can significantly boost your ecommerce sales by making larger purchases more accessible to customers. However, choosing the right financing partner is crucial to ensuring a smooth and profitable experience. Here are some key factors to consider:

1. Compatibility with your business model: Evaluate whether the financing partner’s services align with your target market, product categories, and average order value. Consider factors like minimum order value, loan terms, and repayment options.

2. Fees and pricing: Understand the different fees involved, including origination fees, interest rates, and monthly service charges. Compare these costs across various providers to find the most cost-effective solution for your business.

3. Technology and integration: Look for a financing partner with a seamless integration process into your existing ecommerce platform. This will simplify the checkout process and provide a smooth customer experience.

4. Customer support and risk management: Choose a provider with a strong reputation for customer service and effective risk management. This will minimize potential problems and ensure a positive experience for both you and your customers.

5. Industry experience and reputation: Prioritize financing partners with proven track records in your industry. Look for companies with established partnerships and positive customer feedback.

By carefully considering these factors, you can choose a financing partner that aligns with your business goals and provides a valuable service to your customers. This will enable you to unlock significant sales potential and increase customer satisfaction.

Key Features to Look for in an Ecommerce Financing Provider

Offering financing options to your ecommerce customers can be a game-changer, unlocking a world of potential sales and boosting customer satisfaction. But choosing the right financing provider is crucial. Here are some key features to look for:

Seamless Integration with Your Ecommerce Platform

The financing process should be smooth and user-friendly for both you and your customers. Look for providers that offer easy integrations with your existing ecommerce platform, such as Shopify or Magento. This ensures a seamless checkout experience for your customers, minimizing friction and maximizing conversions.

Flexible Financing Options

Different customers have different needs. Offer a variety of financing options, including installment plans, deferred payments, and interest-free periods. This caters to a wider range of budgets and purchasing preferences, enabling more customers to take advantage of your products or services.

Competitive Interest Rates and Fees

While offering financing can boost sales, it’s essential to remain competitive. Choose a provider with transparent pricing and competitive interest rates and fees. Transparent pricing fosters trust with your customers, encouraging them to utilize financing options without apprehension.

Excellent Customer Support

Your customers should have access to responsive and knowledgeable customer support, both for you and the financing provider. Look for a provider with dedicated customer support teams who can answer questions, resolve issues, and provide assistance throughout the financing process.

Data and Analytics

Understanding the impact of financing on your business is crucial. Choose a provider that offers robust data and analytics dashboards to track key metrics, such as financing conversion rates, average loan amounts, and customer repayment behavior. This data empowers you to optimize your financing strategies for maximum impact.

By carefully considering these key features, you can select a financing provider that aligns with your business objectives and unlocks the true potential of financing for your ecommerce store.

Integrating Financing Options into Your Ecommerce Platform

Offering financing options on your ecommerce platform can significantly boost your sales by making your products more accessible to a wider audience. This strategy can be particularly effective for high-ticket items or products that customers may not be able to afford outright.

Integrating financing options into your platform can be done through various methods. Partnering with a third-party financing provider is often the simplest and most convenient option. These providers handle the entire financing process, from application to payment processing, allowing you to focus on your core business. Another option is to offer in-house financing. This allows you to have more control over the terms and conditions, but it requires setting up a dedicated financing department.

When deciding which method to use, consider the following factors: your business size, the types of products you sell, your target audience, and your budget. It’s also important to choose a financing provider with a proven track record and excellent customer service.

To ensure a smooth integration, select a financing provider that seamlessly integrates with your existing ecommerce platform. This will minimize the need for manual processes and ensure a positive customer experience. Also, be sure to clearly communicate the financing options available on your website, including eligibility criteria, interest rates, and repayment terms.

By offering financing options, you can unlock significant sales potential and reach new customers who may have been hesitant to purchase your products outright. It’s a powerful strategy that can transform your ecommerce business.

Promoting Financing Options to Maximize Visibility and Uptake

Offering financing options can be a powerful tool for boosting sales and conversions in your e-commerce store. But it’s not enough to simply offer these options – you need to ensure they are visible and accessible to your customers.

Here are some strategies to promote your financing options and maximize their uptake:

- Highlight financing options prominently on your product pages: Make sure your financing options are clearly visible on each product page, ideally next to the price. This allows customers to see their financing options before they even add the product to their cart.

- Use clear and concise language: When describing your financing options, use simple language that’s easy to understand. Avoid jargon and technical terms.

- Include a financing calculator: A financing calculator can help customers quickly estimate their monthly payments and see the total cost of financing.

- Showcase positive customer testimonials: If you have customers who have successfully used your financing options, share their positive experiences through testimonials or case studies.

- Run targeted promotions: Promote your financing options through targeted advertising campaigns on social media and search engines. You can also offer limited-time incentives, such as 0% financing for a specific period.

- Use pop-up messages: Strategic pop-ups can be a good way to gently nudge customers towards exploring financing options. For example, you could offer a pop-up that appears when a customer adds a high-value item to their cart.

- Integrate financing options with your checkout process: Make it easy for customers to select financing options during checkout. Allow them to see their payment options clearly and choose their preferred method.

By actively promoting your financing options and making them easily accessible, you can encourage more customers to take advantage of them, leading to increased sales and customer satisfaction.

Addressing Common Concerns About Ecommerce Financing

Offering financing options can be a powerful tool to boost your e-commerce sales, but some merchants hesitate due to concerns about the process. Let’s address some common worries and explain how you can alleviate them:

Concern 1: Increased Costs

While there are fees associated with using a financing provider, they often get offset by the increased sales you’ll generate. Plus, you can negotiate rates and find options that fit your business.

Concern 2: Complex Integration

Many financing providers offer easy-to-integrate solutions. They may have plugins for popular e-commerce platforms, simplifying the setup. The benefits often outweigh the effort of integration.

Concern 3: Security Risks

Reputable financing providers prioritize security and employ strong encryption measures. Always vet potential partners carefully, focusing on their security protocols and customer reviews.

Concern 4: Managing Customer Disputes

Reputable financing providers handle customer disputes and manage payment collections. Focus on providing excellent products and customer service, and let the financing provider deal with the rest.

Addressing these concerns can help you overcome hesitation and unlock the power of offering financing options to your e-commerce customers.

Managing Risk and Affordability for Both You and Your Customers

Offering financing options can be a powerful tool to boost sales, but it’s essential to manage risk and ensure affordability for both you and your customers. This involves a careful evaluation of your target audience, the products you offer, and the financing terms you provide.

Risk assessment is crucial. You need to consider the potential for default or late payments, and implement measures to mitigate these risks. This could include credit checks, loan limits, and robust collection processes.

Affordability is equally important. Don’t offer financing that is beyond your customers’ means. Consider their income, debt-to-income ratio, and other financial obligations. Transparent and easy-to-understand financing options are essential to build trust and ensure long-term customer satisfaction.

By striking the right balance between risk and affordability, you can unlock the power of financing options while protecting your business and empowering your customers to make informed financial decisions.

Providing Transparent and Easy-to-Understand Terms and Conditions

Offering financing options can be a powerful way to increase sales and attract new customers, but it’s crucial to ensure your terms and conditions are transparent and easy to understand. Complicated or confusing terms can lead to customer frustration and distrust, potentially impacting your sales and brand reputation.

Here are some key tips for creating clear and accessible financing terms:

- Use plain language: Avoid industry jargon and technical terms that customers may not understand. Instead, use simple and straightforward language that everyone can comprehend.

- Break down information into digestible chunks: Long blocks of text can be overwhelming. Break down your terms and conditions into smaller, manageable sections with clear headings and subheadings.

- Use visuals: Charts, tables, and bullet points can make complex information easier to absorb. Consider using visuals to illustrate key aspects of your financing options.

- Highlight key information: Use bold text, different font sizes, or color to emphasize important details like interest rates, fees, and repayment terms.

- Make it readily available: Ensure your financing terms and conditions are easily accessible on your website and in your checkout process. Customers should be able to access this information without any hassle.

By taking these steps, you can create clear and accessible financing terms and conditions that build trust and encourage your customers to confidently explore your financing options.

Ensuring Data Security and Compliance with Industry Regulations

When you offer financing options on your e-commerce platform, you’re handling sensitive customer data, including financial information. This makes data security and compliance with industry regulations paramount.

Here’s how you can ensure the safety and privacy of your customers’ data:

- Choose a reputable financing partner: Partner with a company that has strong security measures in place and complies with industry standards like PCI DSS (Payment Card Industry Data Security Standard).

- Implement robust security protocols: Use encryption for data transmission, secure storage, and access controls to protect your customers’ data.

- Stay informed about regulatory updates: Keep up-to-date with evolving regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). Regularly review and update your security policies and practices.

- Be transparent with your customers: Clearly communicate your data handling practices and privacy policies to your customers. Provide them with the ability to access, modify, or delete their data.

By prioritizing data security and compliance, you build trust with your customers, minimize risk, and create a secure environment for them to access financing options.

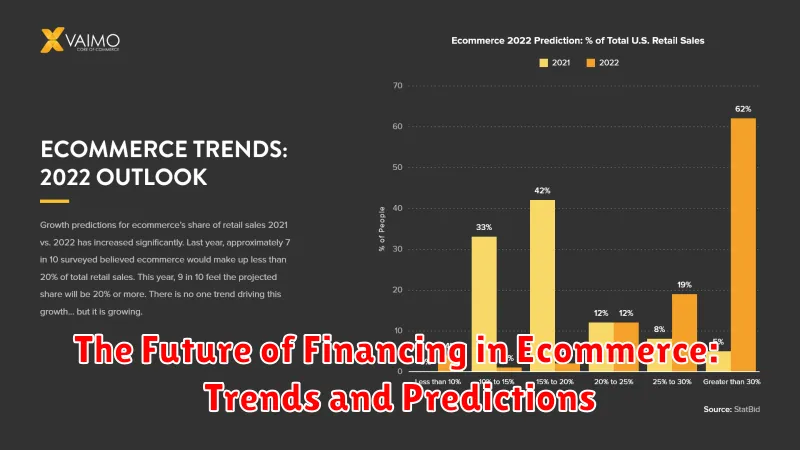

The Future of Financing in Ecommerce: Trends and Predictions

The way consumers finance their online purchases is changing rapidly. Ecommerce financing is becoming increasingly popular, offering shoppers greater flexibility and convenience. This trend is only expected to accelerate in the coming years.

Here are some key trends shaping the future of financing in ecommerce:

- Increased adoption of Buy Now, Pay Later (BNPL): BNPL solutions have exploded in popularity, offering consumers a way to spread out the cost of their purchases over several installments. This trend is likely to continue, with more merchants adopting BNPL options and new players entering the market.

- Personalization and tailored financing options: Ecommerce businesses are increasingly using data to offer personalized financing options based on individual customer behavior and preferences. This includes offering different payment plans, interest rates, and loan terms based on creditworthiness.

- Integration of financing options into the checkout process: Seamless integration of financing options at checkout will be crucial for a smooth customer experience. This will allow consumers to choose their preferred financing option quickly and easily without leaving the checkout process.

- Growing importance of transparency and trust: As ecommerce financing becomes more prevalent, customers will increasingly demand transparency from lenders and merchants. Clear communication about fees, interest rates, and repayment terms is essential to build trust.

- Emphasis on affordability and accessibility: Ecommerce businesses are focusing on offering affordable financing options that are accessible to a wider range of consumers. This includes offering flexible payment plans, low-interest rates, and financing options for customers with less-than-perfect credit.

By staying ahead of these trends and embracing innovative financing solutions, ecommerce businesses can unlock significant growth potential. By offering flexible and convenient payment options, businesses can attract more customers, increase average order values, and drive higher conversion rates.